SUPPORT [BRILLIANT] YOUTH

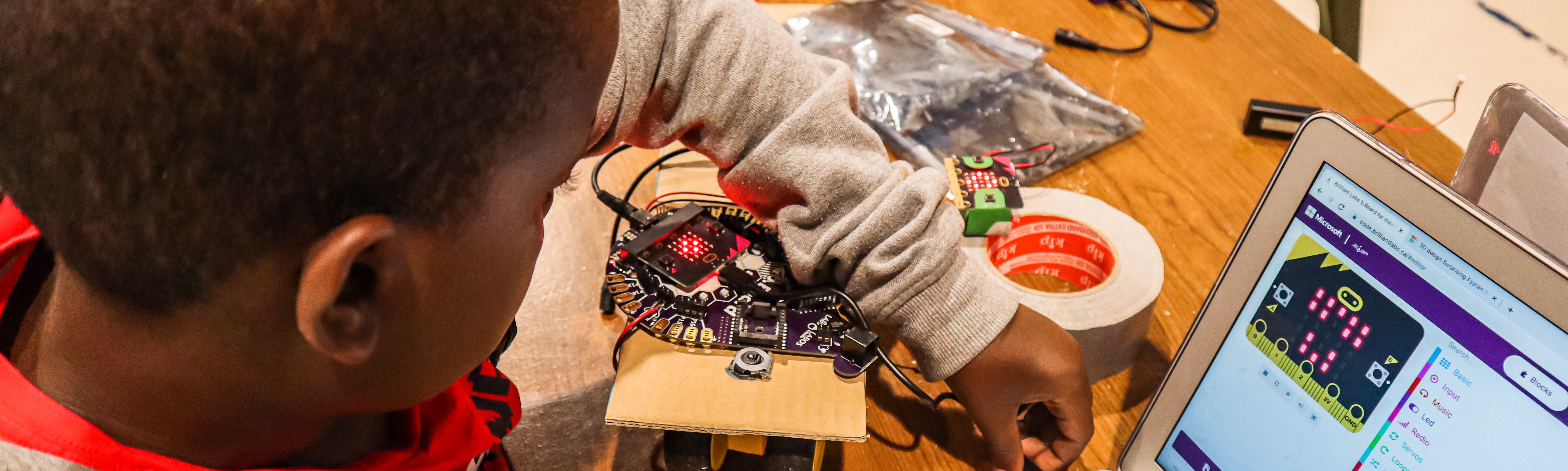

Brilliant Labs is a registered Canadian charity. Every donation to Brilliant Labs supports the education and empowerment of youth from all walks of life and learning abilities to develop into self-starters, lifelong learners, and innovators and creative problem-solvers, and to help build a bigger and brighter future in Atlantic Canada.

“I just want to say these programs are awesome, engaging and interesting. They have been a life saver for us by keeping my son learning.”

– Parent commenting on our free and virtual STEAM camps

As a registered charity under Canada Revenue Agency, Brilliant Labs strictly adheres to the Code of Ethical Standards, Donor’s Bill of Rights, and the Principles of the eDonor Bill of Rights by the Association of Fundraising Professionals.

Donate today

And consider a monthly donation. 12 gifts in 12 months helps to support youth education and empowerment all year long.

Donate

To bring creativity, innovation, today’s digital technology, the UN SDGs and a social entrepreneurial spirit to children in schools and communities.

Cheques should be made payable to: Brilliant Labs

Please mail your contributions to:

Brilliant Labs

1 Germain Street, Suite 300

Saint John, NB E2L 4V1

For more information or if you have a question about a donation, please contact us:

Email: donations@brilliantlabs.ca

FAQs

When you make your donation online, you will be given a choice to designate your gift to the Area of Greatest Need, After-school Programs, Makerspaces, Carts and Kits; or Summer STEAM Camps.

You can also designate where you would like your donation to go when you donate by cheque by writing it in the subject line, or when you make your donation over the phone.

Brilliant Labs is a registered charity under Canada Revenue Agency. As such, you will receive an official charitable tax receipt for income tax purposes with your donation.

Like all other registered charities, Brilliant Labs must adhere to the Canada Revenue Agency (CRA) Income Tax Act when issuing charitable tax receipts. Detailed information and guidelines can be found on CRA’s Charities and Giving website: https://www.canada.ca/en/services/taxes/charities.html

When you donate online, you will automatically receive an official charitable tax receipt for income tax purposes right after your donation has been processed.

If you donate by mail or phone, you will receive your tax receipt in the mail shortly after your donation has been received.

Brilliant Labs respects your privacy and adheres to all the legislative requirements and fundraising best practices, as outlined in the Code of Ethical Standards and The Donor’s Bill of Rights by the Association of Fundraising Professionals (AFP) with respect to protecting your privacy.

We do not share, sell, or trade our mailing list. We use the information you provide to us to help keep you informed of the impact of your donation, and for tax receipt purposes only. If at any time you wish to be removed from our contact list, please email us at donations@brilliantlabs.ca.

Other ways you can help support Brilliant Labs

Brilliant Labs’ volunteers share our commitment to supporting the education and empowerment of Atlantic Canadian youth. Volunteers with a diverse range of educational and professional backgrounds and lived experience play a key role in our programming, fundraising, awareness, and activities. We recruit volunteers with the skills, experience, qualifications, and passion to meet our needs and offer rewarding opportunities to impact the lives of youth.

For more information, contact Amanda Sherman, Human Resources Manager at amanda.s@brilliantlabs.ca.